What Is Check Washing Fraud?

Despite the declining popularity of paper checks, fraudsters are still finding ways to capitalize on them. A trending form of fraud, called “check washing,” has become increasingly recognized at financial institutions across the U.S.

Table of ContentsFraud Prevention Resources

Scammers employ various tactics to obtain checks. Typically, they target standalone mailboxes in residential areas, which are the safest targets.

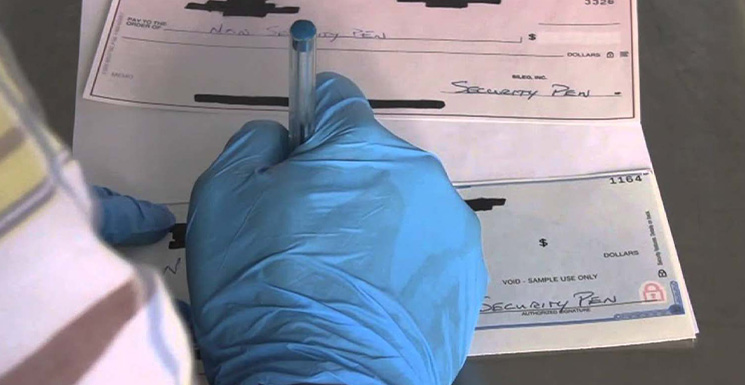

By rifling through mailboxes, they search for signed checks that individuals have sent. Once a suitable check is found, they use chemical methods to remove the original ink, leaving only the account holder's signature behind.

Then they alter the payee and check amount, attempting to cash it at a bank.

While most banks are privy to this type of fraud, it can be challenging to catch. Fortunately, banks are incredibly diligent in ensuring that anyone who handles checks knows the signs of check washing. Educating staff, however, is not foolproof.

Some scammers are experienced and can alter the check with little evidence. In these cases, the victim most often recognizes the fraud when the excess funds are withdrawn from their account.

If you're someone who prefers to pay by check, primarily via the mail, consider the following tips to protect yourself from this all-too-common scam:

Avoid mailing checks when possible. Instead, drop checks off directly to the recipient or pay online. If you must mail a check, take it directly to the post office.

Retrieve your mail frequently. If you'll be on vacation and can't check the mailbox daily, consider holding your mail at the post office until you've returned.

Always write your checks in dark, permanent ink. This tip complicates the washing process and will make the finished product less convincing at the bank.

Always watch for checks to clear your account. Ensure that the funds withdrawn match the amount you wrote the check for, and view the image to ensure nothing was altered when possible.

If you see discrepancies, contact your financial institution immediately. The sooner you identify the scam, the easier it is to identify the individual involved and get your funds returned.

For more information on common scams and how to avoid them, visit FSB's Fraud Prevention Center.

Recognize the signs of counterfeit money to protect yourself.

Learn the communication tactics scammers use to trick you.

Learn how to spot grandparent scams and protect yourself from fraud.