Stay Ahead of Emerging Fraud Threats

Fraud schemes are constantly evolving, and local scams can target residents and businesses in unexpected ways. Learn about the latest fraud trends in your area and how to protect yourself.

Reporting Fraud

If you suspect fraudulent activity or have concerns about your account security, please call FSB directly at (319) 377-4891.

Local Fraud Trends

Learn about the latest scams targeting local Iowa communities.

Consumer Fraud Trends

Arm yourself against fraud with expert insights on the latest Iowa trends.

Business Fraud Trend

Learn about the latest business fraud affecting Eastern Iowa organizations.

Spot and Avoid Financial Fraud

Counterfeit bills, check fraud, and payment scams can threaten your financial security. Discover key warning signs and steps to take if you suspect fraudulent activity.

Reporting Fraud

If you suspect fraudulent activity or have concerns about your account security, please call FSB directly at (319) 377-4891.

Money Fraud

Protect your finances from counterfeit fraud with awareness.

Counterfeit Money

Recognize the signs of counterfeit money to protect yourself.

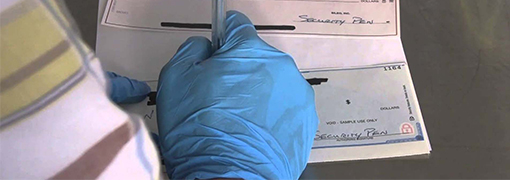

Check Washing

Discover how to prevent your checks from being altered and cashed.

Protect Your Information Online

Cybercriminals use phishing, malware, and data breaches to steal personal and financial information. Strengthen your online security with simple yet effective precautions.

Reporting Fraud

If you suspect fraudulent activity or have concerns about your account security, please call FSB directly at (319) 377-4891.

Online Security

Get tips to strengthen your digital security and protect against online threats.

Computer Security Tips

Enhance your online security to defend against digital fraudsters.

Identifying Phishing Attempts

Learn the communication tactics scammers use to trick you.

Recognizing Scams

Scammers often tailor their tactics to specific groups, from seniors to small business owners. Learn how to identify and avoid scams designed to exploit trust and urgency.

Reporting Fraud

If you suspect fraudulent activity or have concerns about your account security, please call FSB directly at (319) 377-4891.

Targeted Scams

Discover how to identify targeted scams and keep your loved ones safe.

Identifying Grandparent Scams

Learn how to spot grandparent scams and protect yourself from fraud.

Preventing Social Security Fraud

Find out how to spot and prevent Social Security fraud.

Additional Fraud Resources

Local Fraud Trends

Stay in the Know

Get instant notifications about account activity to help you quickly catch any unauthorized transactions.