What To Do If You Sent Money to a Scammer

You realize it the moment you hit send. The person you wired money to isn’t who they claimed to be, and now your money is gone. This happens more often than people think.

Whether the scam involves a fake car sale, a false investment, or an online relationship, what you do next determines how much can be recovered and how protected you’ll be in the future.

Act immediately by contacting your bank and local police.

The faster you report, the greater your chance of recovery.

Never resend money to “reverse” or “fix” the issue.

Keep detailed records of every message and transaction.

First Steps After Sending Money

What Happens When You Report Fraud

When money has already left your account, time matters more than anything else. Acting quickly gives your bank and law enforcement the best chance to intervene.

Contact your bank right away. Explain that you’ve been scammed and ask them to start a recall or freeze on the transaction

File a police report. Provide the case number to your bank for documentation

Report the scam online at IC3.gov for internet-related crimes or reportfraud.ftc.gov for others

Keep evidence. Save screenshots, receipts, and email exchanges for investigators

Do not resend money to the scammer, even if they promise to return the first payment

Avoid deleting emails or messages that show what happened

And most importantly, don’t wait to report because of embarrassment; you’re far from the only one this has happened to

The sooner your bank knows, the better your chances of recovery.

Once you’ve contacted your bank, the following steps depend on how you made the payment. Some transactions are nearly instant, while others allow a short window for reversal.

Wire transfers are the fastest way to move money, which is why scammers prefer them.

Your bank will reach out to the receiving institution to request a hold or reversal, but if the funds have already been withdrawn, recovery is unlikely.

When a transfer is sent through platforms like Zelle®, Venmo, or ACH, there’s a small window (24 to 48 hours) for dispute.

Reporting early allows your bank to contact the platform and attempt to recover funds before they clear.

These payment methods offer almost no recovery options once the payment is complete. Still, you should report them.

The information you provide can help identify scammers and stop them from targeting others.

Most victims don’t realize how sophisticated modern scams have become. Fraudsters use emotion, authority, and technology to create trust before making a single request. Awareness is your most vigorous defense.

These tactics exist to force quick decisions, so spotting them early is your best defense.

Urgency: “You need to act now or lose your chance.”

Authority: “I’m from your bank, and your account is at risk.”

Emotion: “Your grandchild is in trouble and needs help immediately.”

Limited payment options: “We only accept wire transfers or gift cards.”

If a message causes panic, stop. Take a breath, verify, and never rush a financial decision.

Always confirm payment instructions using a verified phone number or a known contact, not one listed in a message or email.

For business transactions, call a vendor directly before sending large sums or updating account details.

Simple changes like these make your accounts harder to compromise and give you more control over every transaction.

Set limits on daily online transfers

Turn on account alerts for all withdrawals and transfers

Use multi-factor authentication for your online accounts

Update passwords regularly and avoid reusing them across accounts

Minor adjustments like these make it harder for criminals to access your information or rush you into a bad decision.

FSB’s local teams are trained to respond quickly and guide customers through every step of the reporting process.

Even if you only suspect something is wrong, reaching out early allows us to act before the funds are lost for good.

Our fraud and operations teams work directly with other banks to recover funds and document evidence for investigators.

We also help customers secure their accounts and review digital settings to prevent future incidents.

Through branch conversations and Fraud Awareness Week resources, FSB helps customers understand new scam trends and build habits that keep them safe.

Reporting isn’t about blame; it’s about stopping the next scam before it starts.

If you think you’ve sent money to a scammer, contact your local FSB branch immediately. Acting fast gives you the best chance to recover and protect your accounts.

See how AI tools help scammers create convincing calls, videos, and more.

Learn how local Iowans spotted scams before losing money.

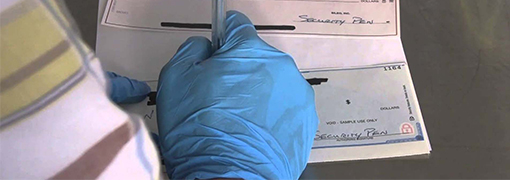

Discover how to prevent your checks from being altered and cashed.