Looking to earn interest on your everyday money? FSB's High-Yield Rewards Checking Account helps you grow your balance with a tiered rate by meeting simple monthly requirements.

See How Much You Could Earn Annually!

*The ‘earned per year’ amount shown is calculated by assuming a full year at the ‘account balance’ amount selected in the slider. Your results may vary as your daily account balance fluctuates. APY assumes interest compounds and remains on deposit at 3.50% APY.

Benefits of Our High-Yield Rewards Checking Account

Tiered Interest

Earn interest as high as 3.50% APY on your checking account balance.

No Monthly Fees

Keep the account free when you maintain a $1,000 minimum balance.

ATM Flexibility

Use any ATM with 5 free non-FSB withdrawals and fee reimbursements.

High-Yield Rewards Checking Account Features

This account focuses on interest, flexibility, and everyday value.

How to Earn Interest

Interest Rate Structure

- Tiered interest rate tied to the Deposit Rate Index

- Balances $0 to $20,000 earn at 3.50%

- Balances $20,001 & over earn at 0.15%

Requirements to Qualify Each Statement Cycle

- Direct deposit to your FSB checking account

- eStatements enrollment (Learn how to enroll in eStatements)

- Minimum of 15 debit card transactions for $20 or more (excludes ATM transactions)

Additional Account Details

Account Minimums & Fees

- Minimum to open: $1,000

- Minimum balance to avoid fees: $1,000

- Monthly fee if below $1,000 minimum: $51

ATM Access & Reimbursement

- 5 free non-FSB ATM withdrawals per statement cycle

- $2 per withdrawal after 5 free withdrawals

- Up to $10 reimbursement2 per statement cycle for ATM fees at non-FSB ATMs

- Unlimited ATM access at FSB-owned ATMs

Start Earning With Our High-Yield Checking Account

FSB’s High-Yield Rewards Checking Account helps you earn interest on your everyday balance with a few simple requirements. Apply online to get started!

Open your High-Yield Rewards Checking Account with $1,000 to get started.

Set up direct deposit and enroll in eStatements to meet the monthly requirements.

Make at least 15 debit card purchases of $20 or more each cycle to qualify for interest.

Additional Perks Included With Every FSB Checking Account

Every FSB checking account gives you core banking features that support secure, convenient money management in Iowa.

Instant-Issue Debit Cards

Get a free contactless debit card printed at select FSB locations.

Unlimited FSB ATM Transactions

Make unlimited ATM transactions at FSB-owned ATMs.

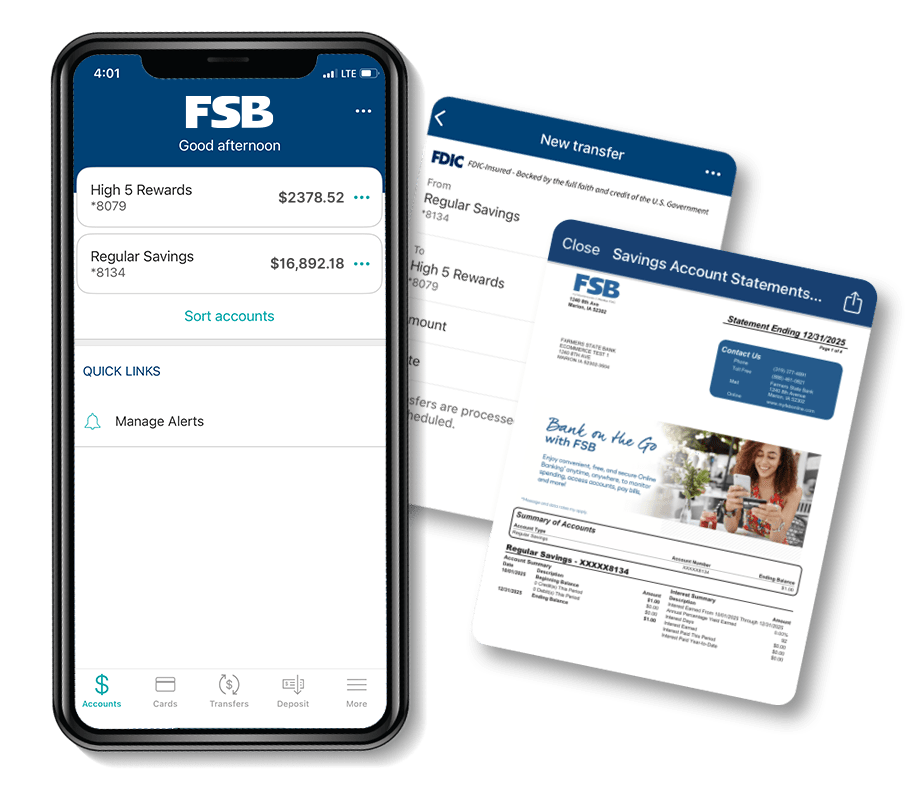

Online & Mobile Banking

Access your account from your desktop or the FSB Now mobile3 app.

Mobile Check Deposits

Deposit checks from anywhere with your mobile3 device.

Custom Account Alerts

Set custom alerts to stay updated on account activity.

eStatements

Get electronic statements for a faster and safer banking experience.

Compare FSB's Personal Checking Accounts

Open Your High-Yield Rewards Checking Account

Start earning more on your everyday money. Our team of personal bankers are ready to help you open your account online or in a branch.

Love my new bank account with FSB. They are understanding, helpful, and focused on their clients’ wellbeing.- Shane O., FSB accountholder in Iowa

Common Questions About High-Yield Rewards Checking

Get quick answers to the most common questions about opening and using your High-Yield Rewards Checking Account.

What is a high-yield checking account?

A high-yield checking account is a checking account that pays a stronger interest rate on the money you keep in it. The account works like a regular checking account with full access to your funds, but you earn interest when you meet the monthly requirements.

These requirements often include using your debit card, enrolling in eStatements, and setting up direct deposit. High-yield checking accounts are designed for customers who want interest earnings without locking money away in a savings account or CD.

How much do I need to open a high-yield checking account?

You need $1,000 to open the account and $1,000 to avoid the monthly fee. If your balance falls below $1,000, the account has a $5 monthly fee. All other features remain the same, including interest eligibility when you meet the account requirements.

How much will $10,000 make in a high-yield checking account?

At 3.50% APY, a $10,000 balance earns about $350 per year, assuming the balance stays at $10,000 for a full year and interest compounds.

How much will $20,000 make in a high-yield checking account?

At 3.50% APY, a $20,000 balance earns about $700 per year, assuming the balance stays at $20,000 for a full year and interest compounds.

Is a high-yield checking account better than a regular checking account?

A high-yield checking account pays interest on the money you keep in it, while a regular checking account usually pays little or no interest.

If you keep a steady balance and use your debit card often, a high-yield checking account provides stronger value. If you keep a low balance or do not meet monthly requirements, a standard checking account might be a better fit.

High-Yield Rewards Checking Account Disclosures

2This account will reimburse ATM surcharges incurred at Non-Farmers State Bank ATMs up to $10.00 per statement cycle.

3Message and data rates may apply.

4Earn a $7 reward each month when you receive eStatements and make at least 25 signature-based debit card transactions (excluding PIN-based and ATM transactions) of $20 or more. The qualifying transactions must post and clear on or before the last business day of the month. When requirements are met, the $7 reward will be credited to your account on the last business day of that month.