Secure Checking1 gives you strong protection tools, everyday convenience, and added coverage, designed for customers who want peace of mind and simple banking with clear requirements.

Benefits of Our Secure Checking Account

Fraud Prevention Services

Access to identity theft3 monitoring, credit file4 monitoring, & more perks.1

Cell Phone Protection

Cell Phone Protection2 up to $400 for replacement or repair costs.

ATM Flexibility

Get 6 free non-FSB ATM withdrawals each cycle, then $2/withdrawal.

Secure Checking Account Features

Secure Checking gives you added protection and simple features that support your everyday banking with peace of mind.

Account Basics

- Minimum opening deposit: $25

- $6 monthly fee6 ($5 if enrolled in eStatements)

- No minimum balance required

- No transaction fees7

Premium Peace of Mind Benefits

- Cell Phone Protection2 up to $400 for replacement or repair costs

-

IDProtect® for you, joint account owners, and eligible family members, including:

ATM Access

- 6 free ATM withdrawals at non-FSB terminals per statement cycle

- $2 per withdrawal after 6 free withdrawals

What You Get With Every FSB Checking Account

Every FSB checking account includes core features that support secure and convenient money management across Iowa.

Instant-Issue Debit Cards

Get a free contactless debit card printed at select FSB locations.

Unlimited FSB ATM Transactions

Make unlimited ATM transactions at FSB-owned ATMs.

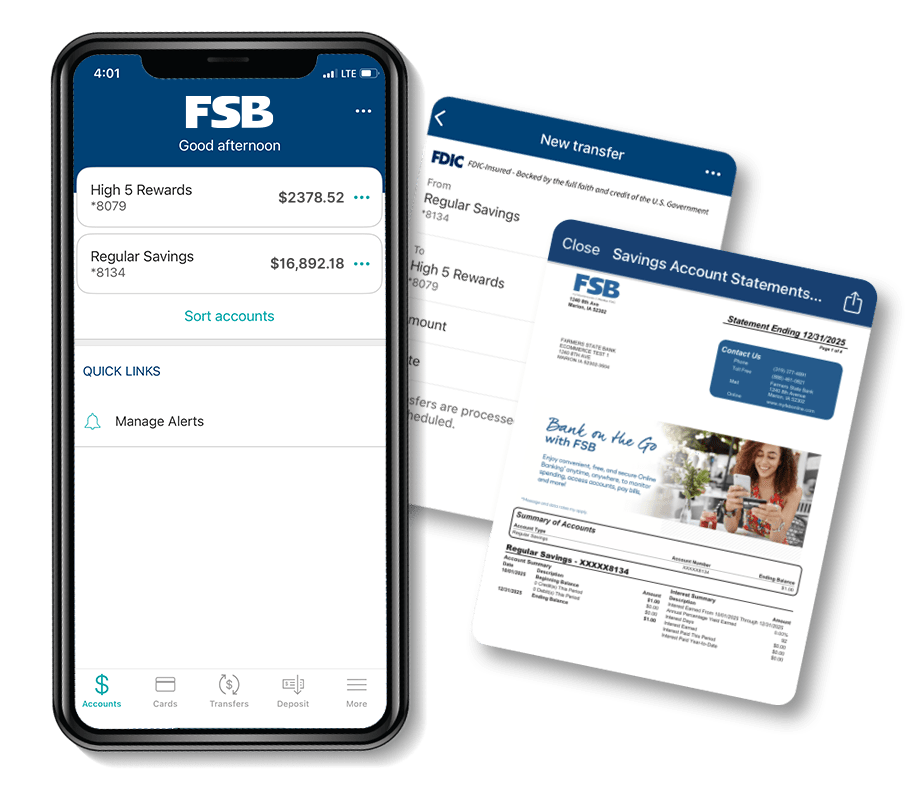

Online & Mobile Banking

Access your account from your computer or the FSB Now mobile8 app.

Mobile Check Deposits

Deposit checks from anywhere with your mobile8 device.

Custom Account Alerts

Set custom alerts to stay updated on account activity.

eStatements

Get electronic statements for a faster and more secure banking experience.

Three Steps to Open Your Secure Checking Account

Secure Checking offers added protection, security benefits, and simple perks1 that give you the peace of mind you want. Apply online to get started!

Apply online or visit any FSB branch with your $25 opening deposit.

Enroll in eStatements to qualify for the lower monthly fee.

Set up your Secure Checking perks to get the full value of the account.

Compare FSB's Personal Checking Accounts

Open Your Secure Checking Account

Enjoy added protection and simple features built for everyday banking. Our personal bankers are ready to help you open your account online or in a branch.

The staff was genuinely welcoming when I opened my account with FSB. The customer service was excellent, and I would recommend FSB to others.- Donna G., FSB accountholder in Iowa

Common Questions About Secure Checking

Get answers to the most common questions customers ask about Secure Checking.

What is Secure Checking?

Secure Checking is a personal checking account FSB offers that includes added protection services at no extra cost beyond the monthly fee. You get identity theft monitoring, credit file monitoring, a quarterly credit report and score, cell phone protection up to $400, and access to a fraud resolution specialist.

The account is designed for customers who want stronger protection and simple everyday banking.

How do I activate the IDProtect® perks?

After your Secure Checking account is open, visit eClubOnline.net and create your account using the activation code in your Welcome Packet.

Once you log in, you can turn on identity monitoring, activate credit file monitoring, and confirm your identity by answering verification questions. You will then receive monthly monitoring alerts and can access your fraud resolution specialist if you ever need support.

How do I activate the cell phone protection benefit?

There is no extra registration step. The coverage begins when you pay your monthly mobile phone bill from your Secure Checking account.

Once the bill is paid this way, you become eligible for up to $400 in repair or replacement coverage for your phone.

Does Secure Checking include identity theft expense reimbursement?

Yes. Secure Checking includes up to $10,000 in identity theft expense reimbursement. This coverage helps with costs related to restoring your identity, including lost wages, document replacement, legal fees, and other approved expenses.

Your coverage extends to your spouse or partner, children under age 25 who live in your home, and parents who live in your household. Each covered person receives access to identity monitoring and fraud resolution support.

How often can I access my credit report and score?

You can view your credit report and score once every 90 days through the IDProtect® portal. The report updates each time you pull it, and you will receive monitoring alerts between updates.

Can I lower the monthly fee on Secure Checking?

Yes. The monthly fee is $6, but it decreases to $5 when you enroll in eStatements. There is no minimum balance required to keep the account open or to lower the fee.

FSB's Secure Checking Account Disclosures

2Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions, and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the insurance document.

3Benefits are available to personal checking account owner(s), their joint account owners, and their eligible family members subject to the terms and conditions set forth in the Guide to Benefit and/or insurance documents for the applicable Benefits. Benefits are not available to a "signer" on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account holder who are residents of the same household.

4Credit file monitoring may take several days to begin following activation.

5Credit Score is a VantageScore 3.0 based on single credit bureau data. Third parties may use a different VantageScore or a different type of credit score to assess your creditworthiness.

6Plus applicable sales tax.

7ATM fees apply after free transactions are used. ATM owners may charge fees.

8Message and data rates may apply.

9Earn a $7 reward each month when you receive eStatements and make at least 25 signature-based debit card transactions (excluding PIN-based and ATM transactions) of $20 or more. The qualifying transactions must post and clear on or before the last business day of the month. When requirements are met, the $7 reward will be credited to your account on the last business day of that month.