FSB’s Benefits Checking Account is our premium account that earns interest† and recognizes the value of your relationship with us. It offers added convenience, exclusive benefits, and a higher level of service designed for customers who expect more from their bank.

Benefits of Our Premium Checking Account

Interest Earnings

Earn interest† with a variable rate that adjusts based on your daily balance.

Premium Perks

Receive free cashier's checks, a free safe deposit box,5 and discounts on paper checks.

ATM Flexibility

Get $20/month in refunds for fees charged by ATM owners. (No FSB ATM fees)

Protection Benefits

Get IDProtect® and cell phone protection2 for added security and peace of mind.

Benefits Checking: FSB's Premium Account

Benefits Checking offers competitive interest rates and valuable everyday perks.

Premium Benefits & Perks

Everyday Banking

- Free ATM transactions at all FSB-owned ATMs1

- Refund up to $20/month in non-FSB ATM fees

- 5 free cashier's checks per month

- No gift card or travel card fees

Identity & Security Protection

-

IDProtect® for you, joint account owners, and eligible family members, including:

- Cell Phone Protection2 up to $400 for replacement or repair costs

Additional Perks

- Free 3x5 safe deposit box5 or the same discount on a larger size

- 25% discount on printed checks

- Exclusive Benefits Checking customer call center: (319) 730-7000

Competitive Interest Rates

Earn competitive interest with our tiered rate structure that rewards higher balances.

| Daily Balance | APY | Rate |

|---|---|---|

| $0 - $999.99 | 0.05% | 0.05% |

| $1,000.00 - $19,999.99 | 0.05% | 0.05% |

| $20,000.00+ | 0.10% | 0.10% |

Rates may vary and are subject to change after account opening. Fees may reduce earnings on these accounts. Interest Rates and Annual Percentage Yields are current as of the date of the last rate change. For current rate information, call 319-377-4891. APY = Annual Percentage Yield | Rate = Interest Rate

Account Requirements & Fees

Account Minimums

- Minimum to open: $100

- Minimum to avoid fees: $20,000 average daily balance of combined consumer deposits, consumer loans, and/or ag loans

- Monthly fee if below minimum:6 $20

Three Steps to Open a Benefits Checking Account

FSB’s Benefits Checking gives you interest† earnings, premium perks, and strong protection features. Apply online to get started!

Open your Benefits Checking Account with a $100 deposit at any FSB branch or online.

Enroll in eStatements to simplify your recordkeeping and stay organized.

Set up your Premium Checking perks, including IDProtect® and cell phone protection.

Compare FSB's Personal Checking Accounts

Features Included With Every FSB Checking Account

Every FSB checking account includes secure, reliable features designed to support your everyday banking needs in Iowa.

Instant-Issue Debit Cards

Get a free contactless debit card printed at select FSB locations.

Unlimited FSB ATM Transactions

Make unlimited ATM transactions at FSB-owned ATMs.

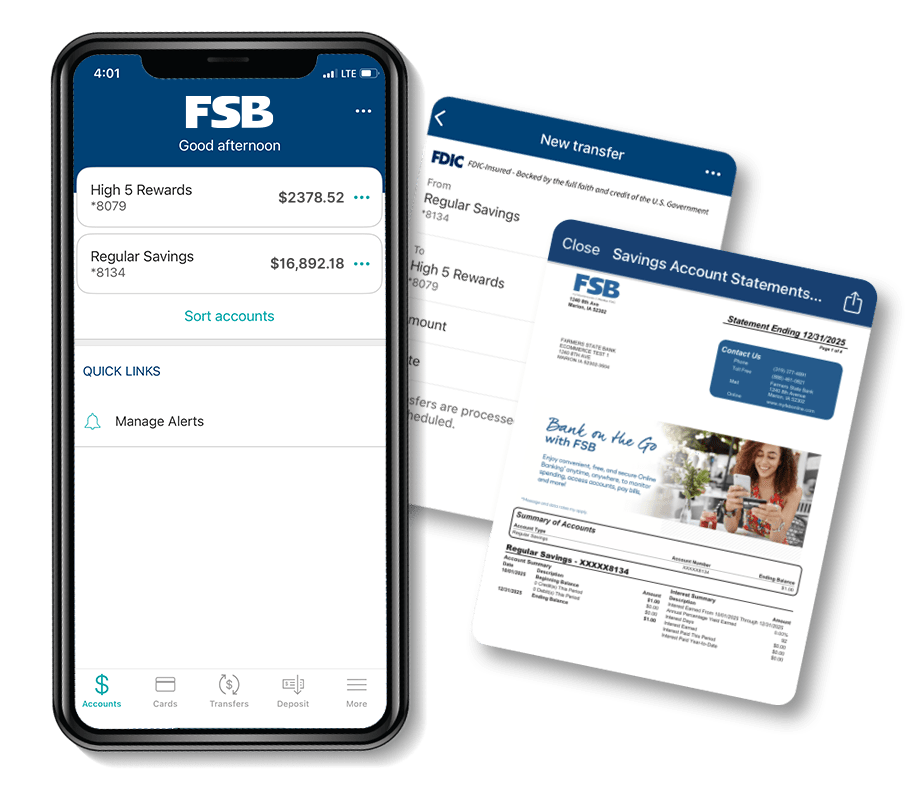

Online & Mobile Banking

Access your account from your desktop or the FSB Now mobile7 app.

Mobile Check Deposits

Deposit checks from anywhere with your mobile7 device.

Custom Account Alerts

Set custom alerts to stay updated on account activity.

eStatements

Get electronic statements for a faster and safer banking experience.

Open Your Benefits Checking Account

Enjoy interest† earnings, premium perks, and added protection features with Benefits Checking. Our personal bankers are ready to help you open your account online or in a branch.

I like knowing my money is handled by people who care. The extra features have been a nice bonus.- Rachel S., FSB accountholder in Iowa

Common Questions About FSB’s Benefits Checking Account

Get quick answers to the most common questions about opening and using your Benefits Checking Account.

What is a Premium Checking Account?

A Premium Checking Account is a checking account that includes interest earnings, added perks, and expanded services that go beyond standard checking.

FSB’s Benefits Checking is a Premium Checking Account that offers interest based on your daily balance, ATM fee refunds, protection services, and benefits such as free cashier’s checks and a free safe deposit box.

It is designed for customers who want more value and prefer a checking account that supports higher combined balances.

Are premium checking accounts worth it?

Premium checking accounts are worth it when you can take advantage of the added benefits. If you keep higher combined balances across checking, savings, or loans, a Premium Checking Account offers stronger value through interest earnings.

The extra perks, including ATM fee refunds, protection services, and free or discounted banking tools, often exceed the monthly cost when the balance requirements are met.

Customers who want more support and everyday convenience find that the added features provide a better banking experience.

Who is FSB's Benefits Checking built for?

FSB's Benefit Checking Account is built for customers who maintain higher balances and want a checking account with added value. It fits individuals who prefer interest earnings, use ATMs regularly, or want services such as IDProtect, cell phone protection, or free cashier’s checks.

It also works well for customers who want broader relationship benefits, since the monthly fee can be waived with combined deposits and loans. This account is a good fit for customers who want one checking account that brings together interest, perks, and added protection.

How do I activate the IDProtect® perks?

After your Benefits Checking account is open, visit eClubOnline.net and create your account using the activation code in your Welcome Packet.

Once you log in, you can turn on identity monitoring, activate credit file monitoring, and confirm your identity by answering verification questions. You will then receive monthly monitoring alerts and can access your fraud resolution specialist if you ever need support.

How do I activate the cell phone protection benefit?

There is no extra registration step. The coverage begins when you pay your monthly mobile phone bill from your Benefits Checking account.

Once the bill is paid this way, you become eligible for up to $400 in repair or replacement coverage for your phone.

FSB's Premium Checking Account Disclosures

3Benefits are available to personal checking account owner(s), their joint account owners, and their eligible family members subject to the terms and conditions set forth in the Guide to Benefit and/or insurance documents for the applicable Benefits. Benefits are not available to a "signer" on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. Family includes: Spouse, persons qualifying as domestic partner, and children under 25 years of age and parent(s) of the account holder who are residents of the same household.

4Credit file monitoring may take several days to begin following activation.

53x5 Safe Deposit Box or equivalent discount on a larger size (not FDIC insured; key deposit required)

6If monthly balance is not met. Plus applicable sales tax.

This account is an interest-bearing account. The interest rate and annual percentage yield will depend upon the daily balance in the account as shown on the Rate Chart. All rates are subject to change without notice. Interest on your account will accrue no later than the business day we receive credit for non-cash items (for example, checks) deposited into your account. If you close your account before interest is credited, you will receive the accrued interest. Interest will be compounded monthly and will be credited to the account monthly. See the Rate Chart for current rates and annual percentage yields.