Checking Built for Students

FSB’s Student Checking Account1 grows with you from high school through college and beyond. Designed for students ages 13 to 23, this account keeps banking simple so you can stay focused on school, work, and life.

Student Banking That Works for Your Life

ATM Flexibility

Enjoy 3 free non-FSB ATM withdrawals and up to $10 in fee reimbursements.

No Monthly Fees

Bank without monthly maintenance fees while you're a student.2

No Minimum Balance

Keep your account open with no minimum balance requirement.

Student Checking Account Details

Student Checking1 is built for students ages 13 to 23 to keep banking easy while you focus on school, work, and daily expenses.

Account Basics

- Minimum opening deposit: $25

- No minimum balance required

- No monthly maintenance fee

- No transaction fees2

ATM Access

- 3 free ATM withdrawals at non-FSB terminals per statement cycle

- $2.00 per withdrawal after 3 free withdrawals

- Up to $10 in ATM fee reimbursements each cycle

Online account opening is not available - please stop by any FSB Branch to get started!

Everything You Need to Bank Your Way

Your FSB Student Checking includes tools to help you manage your money from anywhere.

Instant-Issue Debit Cards

Pick up a free contactless debit card printed at select FSB locations.

Unlimited FSB ATM Transactions

Make unlimited ATM transactions at FSB-owned ATMs.

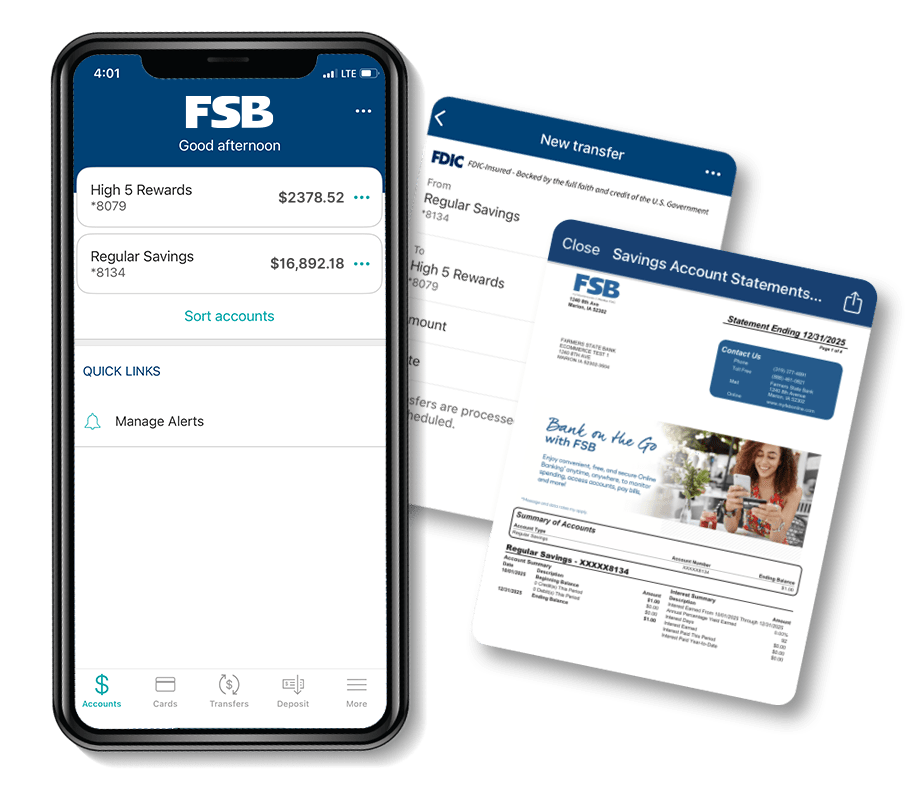

Online & Mobile Banking

Manage your account from your computer or the FSB Now mobile3 app.

Mobile Check Deposits

Deposit checks from your phone with the mobile3 app.

Custom Account Alerts

Set custom alerts to track account activity in real time.

eStatements

Switch to eStatements for fast, secure access to your monthly statements.

Compare FSB's Personal Checking Accounts

Open Your Student Checking Account

Start banking with confidence while you focus on school. Our team is ready to help you open your Student Checking Account.1 Stop in to any FSB location to get started.

Common Questions About Student Checking

Get clear answers to common questions students and parents ask.

Who can open a Student Checking Account?

FSB’s Student Checking Account is available to students ages 13 to 23. This includes middle school, high school, and college students.

Students under 18 must open the account with a parent or guardian as a co-owner at an FSB branch.

What is the difference between a student checking account and a regular checking account?

A student checking account is designed specifically for younger account holders and focuses on low costs and simple access. Student checking accounts usually have no monthly maintenance fee, lower opening deposit requirements, and fewer balance restrictions than regular checking accounts.

FSB’s Student Checking Account removes common fees while still providing everyday banking tools, making it easier for students to manage money while in school or starting out.

What do I need to open a student checking account?

To open a Student Checking Account at FSB, you need a $25 opening deposit. Students under 18 years of age must have a parent or guardian listed as a co-owner on the account.

Online account opening is not available, so you must visit an FSB branch to open the account.

What is required with my Student Checking Account?

To maintain a Student Checking Account at FSB, you must enroll in eStatements.

Students under 18 years of age must have a parent or guardian listed as a co-owner on the account.

There is no minimum balance requirement and no monthly maintenance fee for this account.